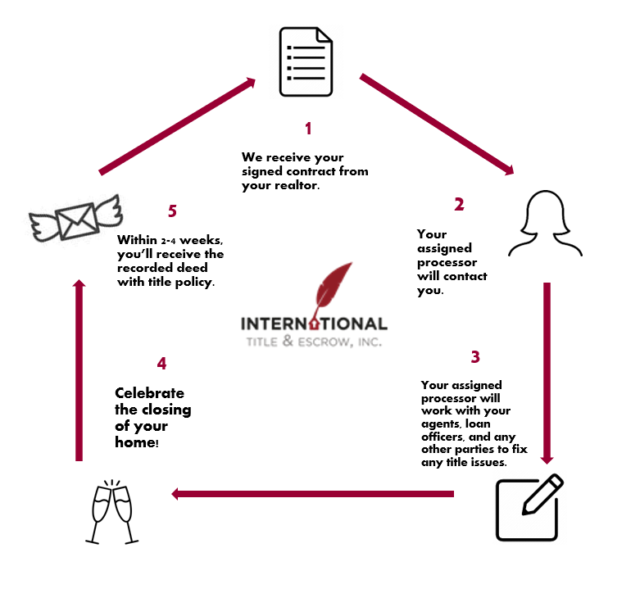

Our job as a settlement company is to ensure that the title to your real estate is legitimate and provided with title insurance. This protects the property against lawsuits or claims that may arise due to legal disputes during the transfer of the title from the seller to the buyer.

The date of your closing will be scheduled accordingly with your convenience as the top priority. If we cannot find a time, certain measures such as “power of attorney”, which means someone can sign on your behalf, or mailing documents will be taken into consideration. You will be expected to sign several documents prepared by the lender and closing agent. These documents include disclosures, notices, and legal binds. You will need to bring with you a government-issued photo ID, any legal documents that the attorney or processor requests, and a final closing amount in certified cashier’s check if you did not wire your funds before closing.

If you want International Title & Escrow to handle your real estate closing, please call us at 703-821-1212